cayman islands tax treaty

These reduced rates and exemptions vary among countries and specific items of income. The Multilateral Convention on Mutual Administrative Assistance in Tax Matters which allows tax information exchange with more than 140 countries.

Form 8833 Tax Treaties Understanding Your Us Tax Return

Ireland has signed comprehensive Double Taxation Agreements DTAs with 76 countries.

. 73 are in effect. The agreements cover direct taxes which in the case of Ireland are. Since no income taxes are imposed on individuals in the Cayman Islands foreign tax relief is not relevant in the context of Cayman Islands taxation.

Effective in the United Kingdom from 1 April 2011 for corporation tax. And from 15 December 2010 for other taxes. The Cayman Islands and the United States signed their Agreement to Improve International Tax Compliance and to Implement the Foreign Account Tax Compliance Act based on the Model 1 IGA in 2013.

It is not the. After the Cayman Islands was forced to accept information sharing under the EUs Savings Tax Directive in 2004 the UK agreed to move discussion of a tax treaty between the United Kingdom and the Cayman Islands to the head of the queue. Canada - Cayman Islands Tax Treaty.

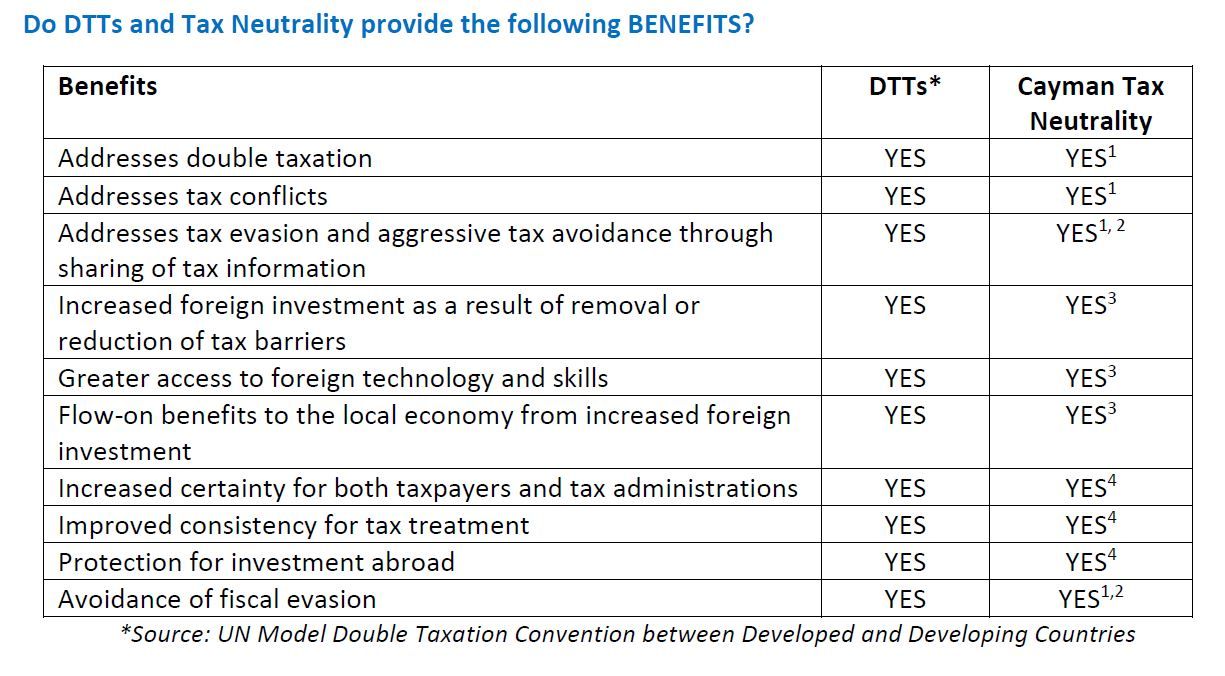

To accommodate the non-direct tax system of the Cayman Islands the IGA is a model 1B non-reciprocal IGA. Not Cayman Islands tax law. The Cayman Islands Tax Neutral regime meets the criteria of an alternative tax policy model.

US- Cayman Islands Tax Treaty And Cayman Islands Expat Tax. Hereinafter referred to as Cayman Islands tax This Agreement shall also apply to any identical or substantially similar taxes that are. We maintain a collection of worldwide double tax treaties in English and other languages where available to assist members with their enquiries.

Foreign tax relief. Does not have a tax treaty with the Cayman Islands and as a result there are no benefits for Cayman Islands Expat Tax from this perspective. Tax Agreement with the Cayman Islands will enter into force.

WHEREAS the Government of the. Tax treaties Tax treaties and related documents between the UK and the Cayman Islands. The US Treasury announced on Friday it would cancel a 1979 tax treaty with Hungary after the country moved to block the European Unions implementation of a new 15 global minimum tax.

The existing taxes to which this Agreement shall apply are in particular. Since then the number of TIEAs that Cayman has in force has proliferated. The first limb of it but without saying so attempts to deal with the failure of the OECD double tax treaty networks which in concert are the facilitators of the egregious transfer pricing and profit shifting strategies that are the root cause of the EUs problem.

On October 14 Tue mutual notification procedures were completed for entry into force of the Agreement between the Government of Japan and the Government of the Cayman Islands for the Exchange of Information for the Purpose of the Prevention of Fiscal Evasion and the Allocation of Rights of Taxation. The Agreement between the Government of the United States of America and the Government of the United Kingdom of Great Britain and Northern Ireland including the Government of the Cayman Islands for the Exchange of Information Relating to Taxes done on November 27 2001 at Washington the 2001 Agreement shall terminate on the date of. Cayman Islands Foreign Bank Account Reporting The FBAR FinCen Form 114.

Under these treaties residents not necessarily citizens of foreign countries may be eligible to be taxed at a reduced rate or exempt from US. Cayman signed its first Mutual Legal Assistance Treaty with the USA in the 1980s and has tax information exchange agreements with 36 jurisdictions. The Cayman Islands and the United Kingdom also.

Hereinafter referred to as Chinese tax b in the Cayman Islands. Automatic data exchange as part of the European Union Savings. Entered into force 20 December 2010.

HM Revenue Customs. To accommodate the non-direct tax system of the Cayman Islands the IGA is a model 1B non-reciprocal IGA. See the Other issues section in the Corporate summary for a description of Bilateral Agreements that the Cayman Islands has entered into.

The Protocol to the existing DTA and Amending. Income taxes on certain items of income they receive from sources within the United States. Taxes of every kind and description.

Together they can exclude as much as 224000 for the 2022 tax year. A common misunderstanding of US citizens and green card holders living in the Cayman Islands is that they do not need to file US income tax returns if their earned income is less than the foreign earned income and housing exclusions discussed below. The Cayman Islands landmark 12th tax information exchange agreement was signed with New Zealand in August 2009 moving the jurisdiction onto the whitelist of countries that have substantially implemented the OECDs internationally agreed tax standard.

The following is a summary of the work underway to negotiate new DTAs and to update existing agreements. UKCAYMAN ISLANDS DOUBLE TAXATION ARRANGEMENT. Representatives from Cayman Islands Government signed a double taxation agreement with the United Kingdom on Monday.

It should also be obvious to the editor of The Economist and in fairness he draws reference to the offending EU based double treaty tax jurisdictions that the zero tax jurisdictions notably the Cayman Islands are in no way involved in the mechanics of profit shifting by way of the application of the excessive transfer pricing practices of these US corporates. From 6 April 2011 for income tax and capital gains tax. US- Cayman Islands Tax Treaty And Cayman Islands Expat Tax.

THE GOVERNMENT OF THE CAYMAN ISLANDS UNDER ENTRUSTMENT FROM THE GOVERNMENT OF THE UNITED KINGDOM OF GREAT BRITAIN AND NORTHERN IRELAND. A in the Peoples Republic of China. Failure Of Double Tax Treaty Networks.

All taxes except customs tariffs. AND THE GOVERNMENT OF CANADA FOR THE EXCHANGE OF INFORMATION ON TAX MATTERS. This is entirely untrue.

SIGNED 15 JUNE 2009. At the time of signing of this Agreement between the Government of Canada and the Government of the Cayman Islands under Entrustment from the Government of the United Kingdom of Great Britain and Northern Ireland for the Exchange of Information on Tax Matters the undersigned have agreed upon the following provisions which shall be an integral part of this Agreement. Effective in the Cayman Islands from 1 April 2011 for corporation tax.

A the term Party means the Cayman Islands or Canada as the context requires. Automatic data exchange as part of the European Union Savings. Cross-border economic transactions involving the Tax Neutral jurisdiction of the Cayman Islands do not require tax treaties as there is.

Cayman Compass is Cayman News.

Outbound Foreign Direct Investment And Tax Treaties Download Table

Cayman Islands Exchange Of Information And Tax Enforcement

/CIA_map_of_the_Caribbean-822e94431d4647ba9ca350ebf28eb23b.png)

Top 10 Offshore Tax Havens In The Caribbean

Morocco Signs Landmark Agreement To Strengthen Its Tax Treaties Oecd

Publications Old Cayman Finance

This Week In Tax Article 12b Is Ready For Use In Tax Treaties International Tax Review

Tax Free Havens Cayman Islands Tax Rates 0

Us Cayman Sign Tax Treaty Nationnews Barbados Nationnews Com

Tiea Between The Cayman Islands The Former Netherlands Antilles To Enter Into Force Orbitax News

Cayman Islands Tax Neutrality Overview Tax Authorities Cayman Islands

What Makes Cayman Islands So Popular For Hedge Funds International Finance

Publications Old Cayman Finance

No More Import Tax For Uk Expats Expat Association Of The Cayman Islands

A Cloudy Day In Paradise For Pharma Tax Havens In Cayman Islands Bermuda Impact Of Oecd Tax Deal On Pharma In Cayman Islands And Bermuda Tax Haven

Copy Of A Review Of Tjn S Financial Secrecy Index

Deals Canada Signed To Catch Tax Cheats Allow Billions In Taxes To Escape Cbc News

Double Tax Treaties In The Cayman Islands Archives Cayman Company Formation