can you opt out of washington state long-term care tax

Employers will not be required to collect the 58 payroll tax until July 1 2023. Lets assume for the moment that you dont opt-out of the Washington long-term care tax program before the December 31 2022 deadline.

Washington S Long Term Care Act

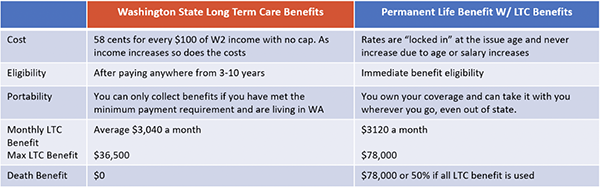

The current rate for WA Cares premiums is only 058 percent of your earnings.

. 2062817211 phone 2062836122 fax. 1 day agoState needs to opt out of its long-term care tax. You will need to attest that you have purchased a private long-term care insurance policy before November 1 2021.

On April 14 2021 the House passed an amendment to the. 1 2022 employers will begin withholding a new payroll tax from employee paychecks as a premium payment for the new long-term care benefit. Applications are available as of October 1 2021.

Washington State Hospital Association 999 Third Avenue Suite 1400 Seattle WA 98104. Washingtons new long-term care insurance tax charges. To qualify for an exemption you must be at least 18 years old and have proof of an eligible LTC policy.

The Washington Cares Fund collects 58 cents for every 100 of income that workers in the state earn until they retire. 509 396-0588 888 474-6520 8905 W. Employees now have until November 1 2021 to purchase long-term care insurance if they wish to opt out of the Washington State Long-Term Care Program.

The video below will walk you through the opt-out process. To opt out you will need to purchase your own long-term care insurance policy as well as file a waiver application with the state between October 1 2021 and December 31 2022 for an exemption from the program. But thats what Washington states 2019 long-term care law will do.

Taking income from todays lower-wage workers for a future benefit they may never need or qualify for is not wise fair or compassionate. The initial premium rate 058. An employee tax for Washingtons new long-term care benefits starts in January.

Long-term care policies must have been purchased by November 1 2021 to qualify for the exemption. Awash in a tsunami of potential new customers long-term care insurance companies have temporarily halted sales in Washington. After months of backlash governor Jay Inslee recently signed a pair of bills to delay and amend the tax for Washingtons long-term care program.

Once youve logged in and selected Paid Family and Medical Leave from your list of services in SAW youll click Continue to proceed to creating your WA Cares Exemption account. New State Employee Payroll Tax Law for Long-Term Care Benefits. This money will cover.

Turns out they were a bit premature. If you meet the opt-out criteria and purchased your LTC policy prior to Nov 1 2021 you have until December 31 2022 to opt-out of the tax. In addition the law was updated so individuals born before January 1 1968 who have.

For someone with annual wages of 50000 thats 290 a year in premiums. The sudden consumer demand for this relatively obscure form of insurance and the resulting shutdown of the market comes as a November 1 deadline looms for Washington residents to purchase a private long-term care. The Washington state House on Wednesday voted 91-6 to delay the implementation of the mandatory long-term care payroll tax by 18 months.

To apply navigate to the WA Cares Fund website and select Apply for an Exemption. Washington has adopted a first-of-its-kind law that both provides a new long-term care benefit and pays for the new benefit with a new tax collected by employers. No matter your age or health status the WA Cares Fund provides affordable long-term care coverage.

In that case the tax will be permanent and mandatory. Long-term care insurance companies have temporarily halted sales in Washington. How do I opt out of WA cares.

On the Create an Account page select the Create an Account button to the right of WA Cares Exemption. You do not need a copy of your policy to file the exemption. On January 27 th Governor Jay Inslee signed House Bill 1732 which delays implementation of the long-term care payroll tax in Washington State for 18 months.

It should be repealed. Individuals who have private long-term care insurance may opt-out. But if you want to opt out you may have some trouble.

You can opt out if you show proof that you have long. The Washington State Long Term Care Program has an extremely limited opt-out exemption window which opens on October 1 2021. Private insurers may deny coverage based on age or health status.

This is also true if you move to Washington state after the opt out window closes after 12312022 and you didnt already own long-term care. The move follows a frenzy of interest in the costly insurance policies prompted by a November 1 deadline to opt out. Applying for an exemption.

Update as of. Washington states Long-Term Care Trust Act is set to take effect at the beginning of 2022 and the only time to opt out of the new tax is fast approaching.

What You Need To Know About The New Washington State Long Term Care Act Coldstream Wealth Management

What You Need To Know About The New Washington State Long Term Care Act Coldstream Wealth Management

What You Need To Know About The New Washington State Long Term Care Act Coldstream Wealth Management

Learn More About The Wa Cares Fund Long Term Care In Wa State

What You Need To Know About The New Washington State Long Term Care Act Coldstream Wealth Management

Toolkit Wa Cares Officially On Hold Until July 2023 Washington Hospitality Association We Deliver Wins For The Hospitality Industry

Where Long Term Care Reform Goes Now

Long Term Care Benefit Through Chubb Afscme Council 28 Wfse

Washington S Long Term Care Plan Is Essential And Must Be Protected Budget And Policy Center

What You Need To Know About The New Washington State Long Term Care Act Coldstream Wealth Management

Washington Capital Gains Tax And Long Term Care Payroll Tax New Taxes And Planning Opportunities In 2022 Merriman

2022 Long Term Care Insurance Information Washington Education Association

Making Sense Of Washington S New Long Term Care Law Parker Smith Feek Business Insurance Employee Benefits Surety

What You Need To Know About The New Washington State Long Term Care Act Coldstream Wealth Management

Wa Long Term Care Coverage Self Employed Opt In Information

Learn More About The Wa Cares Fund Long Term Care In Wa State